This month, Tianjin Chapter's Monthly Executive Breakfast Briefing focused on the recently enacted Individual Income Tax Law《中华人民共和国个人所得税法》reforms set to take full effect on January 1st, 2019. The amendment represents a watershed moment for the Chinese IIT regime, with significant implications for Chinese citizens and expats alike.

Recent relative torpor in China’s economic growth compounded by an intensifying trade dispute with the US has spurred Chinese policymakers to revise its IIT regime. These revisions refine the existing regime’s laws by mixing aggregate and secular taxation systems as and bring significant challenges to expatriates living and working in China. At October’s Monthly Executive Breakfast Briefing, representatives of PwC Global Mobility Services Sandy Cheung and Phoebe Jiang offered their professional insights into these contentious IIT reforms.

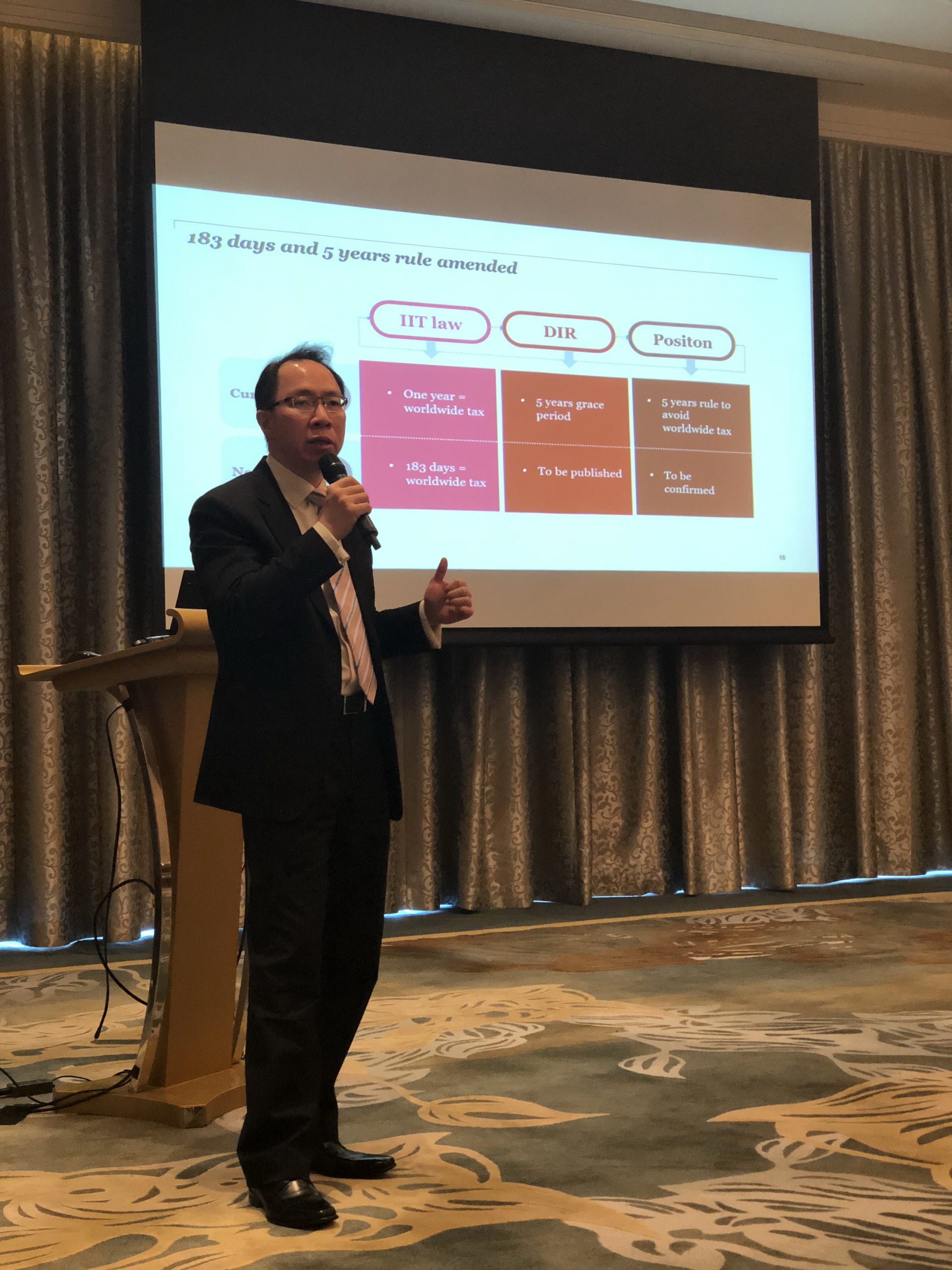

Most significant for expatriates living and working in China is the tightened criteria for tax residency status, from one full year in the past to 183 days. (see AmCham’s China’s New Individual Income Tax (IIT) Regime and Implications for Global Business Insight for more information). Sandy Cheung, however offers a more optimistic perspective, noting that “… the key mission of China is to attract talent …” Thus, as more detailed information is released regarding the scope and criteria of the IIT reforms, expatriates and their companies will have a better idea of how to respond to the challenges of the new 183 day tax residency status.

Thank you to Sandy Cheung and Phoebe Jiang for their insights and to the Shangri La Hotel, Tianjin for hosting the event.

For more news regarding upcoming events in Tianjin, please check AmCham China, Tianjin’s official event page.