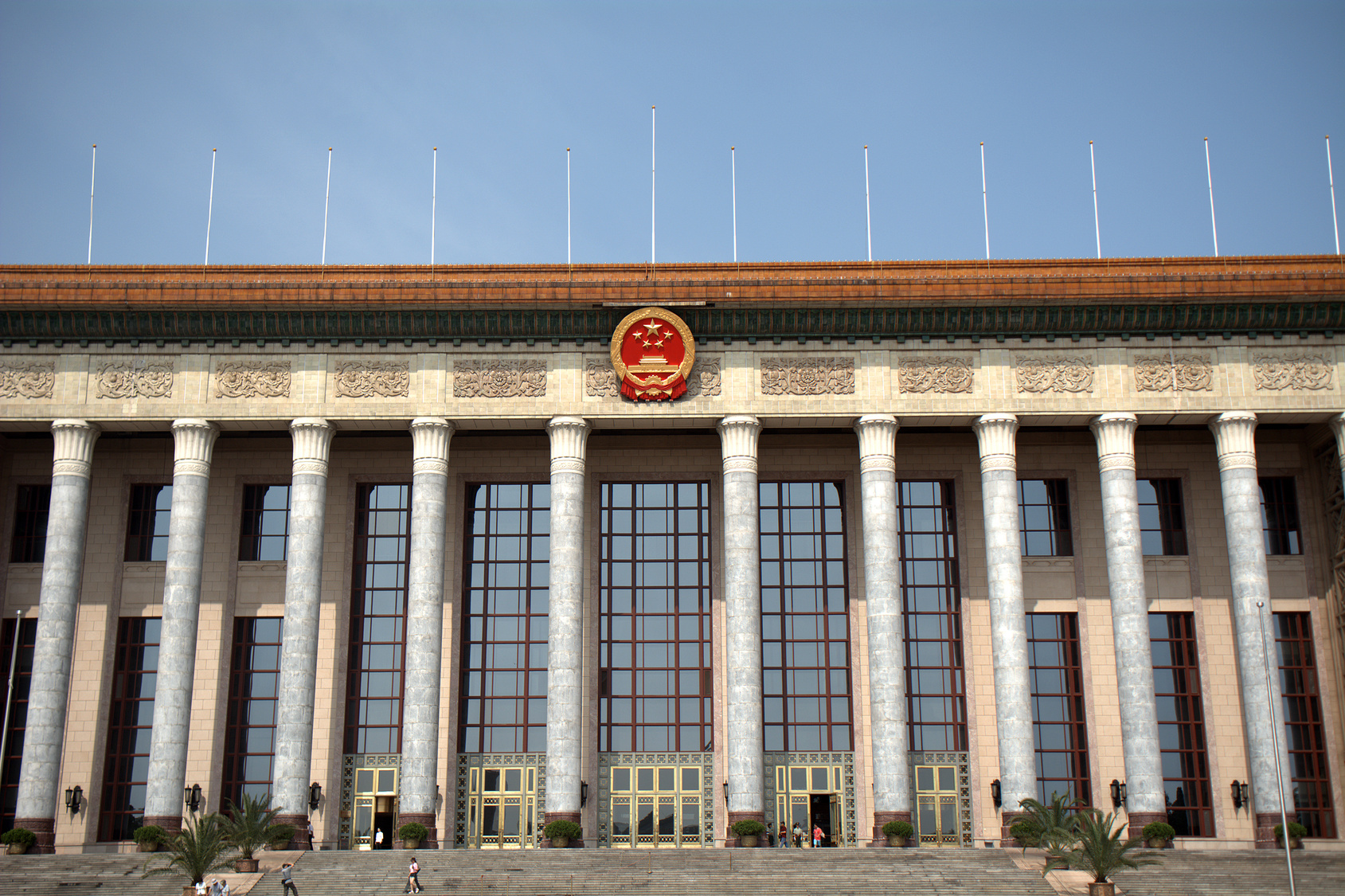

Note: The Lianghui – the annual meeting of the Chinese People’s Political Consultative Conference and National People’s Congress – begins this week. To brief members on what’s in store, Kiran Patel, Marketing and Communications Director at LehmanBrown International Accountants, spoke at the Tianjin monthly executive breakfast on Feb. 25 at the Ritz Carlton. Patel contributed the following article to sum up what businesses should watch out for:

In recent years, the media has continued to speculate on an annual basis that China’s economy will face its most challenging year yet for economic adjustment. Taking into account a rather turbulent 2015 with a volatile stock market crash hitting investor confidence declines in manufacturing and trade, a surging debt to GDP ratio and further RMB depreciation; could they actually be onto something this time?

At the Lianghui this month, the PRC is set to formally implement the 13th Five Year Plan. A brief overview of the key main themes of the 13th Five Year Plan indicate that there is set to be a shift in economic focus to compensate and rebalance in order to address the current pressures facing China as it seeks economic adjustment. This shift will see an economy largely fired previously by heavy industry and manufacturing towards more sustainable orientated economic forms through; innovation, service and retail, infrastructure and overseas expansion. This means that there will be significant changes opening up new opportunities as well as providing new challenges for both Chinese domestic and China focussed foreign businesses operating.

It is important for a business or investor with China interests to have an understanding of the 13th Five Year Plan and how it underpins strategy and alignment to government policy over the forthcoming period. The Five Year Plan outlines the semi-long term government framework of general direction of the government in terms of key economic, social, environmental and industrial policies, setting out clear goals for China to reach from 2016 – 2020.

This article will set out at a high level the background of the 13th Five Year Plan and present an overall picture of how it will impact your business in China.

The Five Tenets of the Five Year Plan

In order to keep the economy on track and achieve the goal of New Normal economic growth, the 13th Five Year Plan has been formulated based on the following Five Tenets:

1. Innovation

This will be the primary driver of economic development to shift China’s economic structure into a higher-quality growth pattern, moving away from the mass manufacturing model that has been the foundation of China’s economic boom until now.

2. Coordination

China will coordinate its agenda to utilize both domestic and global markets while also being more active in global governance.

3. Green Growth

In order to combat the environmental issues resulting from China’s rapid development, future development means protecting the environment and pursuing environmentally friendly economic growth.

4. Opening Up

With previous growth being focused towards the key strategic economic territories, China will seek to emphasize and ensure balanced development among both both rural and urban areas, and across different industries.

5. Inclusive Development

Sharing of the benefits to the wider Chinese population is high on the agenda of the 13th Five Year Plan to ensure that prosperity is shared with the whole nation and delivers improved social services.

Medium to high level growth plan

With an economy in need of re-balancing in order to consolidate competitiveness on the global stage, China will position itself as a key point of innovation, shift its economic drivers from manufacturing to consumption, undergo reforms to its financial system, shift regional and demographic focus of economic policy and build sustainable outlooks in terms of attitude and structure.

President Xi Jinping has set the target of 6.5 percent GDP growth annually and tied in with this will be seeking through the 13th Five Year Plan to close the middle income economic trap, increase annual income per capita to reach RMB 12,600, create 25 million new jobs annually, reduce the population living in rural poverty by 70 million and through regional shift support this with policies of urbanization. The hukou reforms of 2015 already demonstrate an intention to encourage greater flow of talent to secondary and tertiary cities with these developmental clusters serving as growth hubs.

Market and trade liberalization

In terms of China’s Free Trade Zones (FTZs), international investments and international business activity, the 13th Five Year Plan is going to further open up China. President Xi Jinping has been increasing the international presence of China in key regions including Africa and the Asia Pacific, much of which is related to the One Belt One Road (OBOR) Initiative. Additionally, there is also going to be further expansion of FTZs to stimulate further foreign investment into these zones. More Western levels of free trade coupled with increased access to Chinese markets represent at face value increasing business opportunities. The 13th Five Year Plan will likely make provisions for increasing the ease of capital flow into and out of China, making accessing Chinese markets for foreign invested enterprises easier to navigate. Also, proposed tax incentives will make production attractive.

In terms of international financial liberalization China has taken significant steps towards greater freedom in the market. The creation of FTZs and likely expansions are evidence of this and there will be further provisions and movement out of the 13th Five Year Plan to drive this forward. However the depreciation of the RMB during the second and third quarter of 2015, stock market volatility and general global economic uncertainty coupled with fewer reforms than desired by international business community interests has led to skepticism towards the progress of these economic liberalization reforms.

Despite this uncertainty, China still contains considerable market potential and there is still strong belief that liberalization will occur even if slower than expected. Despite this scrutiny, the Chinese government has been active on the global front, securing trade deals in support for the One Belt One Road project and the establishment of the Asia Infrastructure Investment Bank (AIIB).

Additionally, growth of 6.5 percent in 2015 is still a marker of strong development albeit less than expected. For foreign interests the markets that have been liberalized through the FTZ; represent a very small portion of China’s capital market. A more consistent free market would help to ease foreign interest’s concerns. As more areas are opened up, there will not only be opportunities for financial trading, but also other business activities. Trade, logistics, information, professional services and retail are some of the areas that could be explored.

A changing demographic

Demographically China has set itself up for change yet again. The driving force for policy change concerning the growing elderly population was that in 2014, the actual working population in China decreased for the first time. This presents the issue of a receding pool of workers, higher wages and related costs to employers and relocation of manufacturing to other lower cost regions. With this in mind, the much discussed One Child Policy was recently relaxed which will generate opportunities for investment in many areas. There is some skepticism about exactly how successful removing the One Child Policy to drive increased birth rates and help to avoid what has been called “the demographic time-bomb” will be. Notwithstanding this, areas such as production and retail for childcare products, clothing, food stuffs, health care and even areas such as finance, insurance and banking will experience growth. General increases in wealth and an increasing average income are likely to boost the demand for these goods. Additionally, market trends towards sustainable and organic products are areas of possible opportunities for foreign as well as local investors.

The aging population trend will also place strain and growing demands on elderly health care and related services, even though the 13th Five Year Plan is expected to lay out promises to support elderly and their care. Increasing development of rest homes, medical care, housing are all areas with good economic prospects. Traditionally, the general Chinese population could be viewed as frugal, perhaps in part driven by a need for precautionary saving to cover welfare services. A future economic model stimulated by consumerism must work to address this issue and liberalize Chinese consumer spending habits in order to be successful. Aiming for a significant increase in the share of consumption with GDP is a key factor in ensuring that President Xi Jinping's growth target of 6.5 percent annually is achieved.

High tech and green sectors

With Green Growth featuring as a high priority of the 13th Five Year Plan, the government is expected to develop further existing policy with emphasis on promoting high-end technology, R&D and manufacturing as well as alternative green energies in the form of solar and wind.

Additional steps will likely be taken by the government to legislate towards clean energy given the recent Paris 2015 world summit on environmental goals as well as increased national and international attention to air pollution problems across China, particularly in the capital Beijing. There is expected to be a strong presence for environmentally motivated provisions coming out of the 13th Five Year Plan.

The 13th Five Year Plan will likely set out controls and standards to limit inefficient higher polluting activities for which related industries with a poor track record may suffer. Improved legislation will help to address pressure around water supply and demand, carbon emissions and other pollutants in the environment. Entrepreneurs with green technologies, products and services are likely to be able to benefit from this aspect of the plan. In particular the provision of non-fossil fuel energy is going to be a high growth area. Contracts for the provision of infrastructure in this sector as well as intellectual services and industry advice are going to bring about profitable ventures. Innovation will be important in terms of filling market gaps and securing contracts, with President Xi giving an explicit directive that innovation will be at the heart of national development. This is partly driven by China’s need to improve efficiency in order to compete on world stage as well as reinforce movement towards the tertiary economy. There will also be a number of other market opportunities, so therefore the ability to fill shortages in skilled labor or technology will be fundamental.

One Belt One Road (OBOR)

The OBOR initiative being led by China is going to be a critical area of global growth in the foreseeable future, with China at the epicenter. The OBOR initiative is aimed at creating new trans-continental trade routes that will benefit different areas to general globalized trade, particularly undeveloped areas of China. This undertaking is already underway. Local governments have started to plan for new infrastructure and Private Public Partnership Projects. The creation of AIIB to provide finance sent a strong message for China’s commitment to growing stronger global trade relations and maintaining control over financing.

In China, thirteen provinces are expected to benefit from the project which will ultimately have indirect and induced flow on effects to all regions. The 13th Five Year Plan is expected to provide provisions for encouraged economic growth primarily in the Western areas of China. These areas are relatively undeveloped and will therefore offer opportunities for industries from infrastructure and construction to retail services. Investment in new areas will lead to the creation of new markets, offering opportunities for; financial services, architecture firms, design, urban development, restaurants and general amenities all of which can benefit. Six key areas to watch will be healthcare / life sciences, high-tech manufacturing and transport, e-commerce, finance, agriculture and infrastructure.

1.Jiangsu 2.Zhejiang 3.Fujian 4.Guangdong 5.Hainan 6.Yunnan

7.Chongqing Municipality 8.Shaanxi 9.Ningxia 10.Gansu 11.Sichuan

12.Qinghai 13.Xinjiang Autonomous Region

Made in China 2025

The Made in China 2025 initiative brings about an opportunity for China to reform its manufacturing practices and take a significant step into high-end manufacturing. This will enable China to expand into the international market and adapt to the growing challenges that the global manufacturing industry is encountering. New Normal economic growth is dependent on China evolving its manufacturing practices to take advantage of the changing global manufacturing structure that is being shaped by slowdowns both in Europe and the US.

Domestically in China, the negative environmental impact, rising labor costs and increasing competition from low cost competitor regions (particularly in South East Asia) are necessitating China to upgrade its manufacturing processes. Despite China having the largest manufacturing sector in the world, it still lags behind other more developed economies in terms of innovation and core technology. The key ethos of Made in China 2025 will transform China’s position as the world’s largest manufacturer into the world’s strongest manufacturer.

The 10 key focus sector areas of China 2025 have been identified as:

Aviation and Aerospace

Agriculture

Electrical Power

New Energy Automotive

High-End Robotics

Next Gen Information Technology

New Materials & Composites

Rail Transportation

Maritime Engineering

Biomedical & Advanced Medical Equipment

Through applying Made in China 2025, China will emphasize the importance of quality over quantity in terms of manufacturing, achieve green development, nurture human talent and optimize the structure of Chinese industry for the future. Slower growth means that companies need to operate more efficiently, rising wages emphasize the need to be more productive overall and the days of low cost manufacturing for low wages are over.

Education

In terms of development of the education sector, there is an increased flow of students into China to study at Chinese Universities and educational institutions. This is due to the importance of western professionals understanding Chinese business culture and language, instead of the traditional importance of Chinese understanding western business culture. As China continues to grow there will be further opportunities for education providers and third parties in services to enable this market. The 13th Five Year Plan is expected to make it easier for the transfer of education services both into and out of China, continuing this movement towards more open trade links.

Contradictions and caveats

Despite the drive to build future economic growth on Innovation and Entrepreneurship with President Xi stating that China remains open to foreign investment and businesses, the policy has been viewed by some as possessing contradictions and caveats for foreign businesses. While continuing the trend of existing policies, there is no clarity on the operational environment for multinationals and other FIEs with uncertainty caused by laws with undetermined scope of implementation, onerous security laws and a renewed desire to bolster domestic industry. Information control and ideological rhetoric are also ramping up. In order to survive and sustain effective operations in China under the 13th Five Year Plan, it will be invaluable for businesses to align with the policy direction of China and the government’s motivations and develop business strategies around these tenets. China as a market continues to evolve and foreign businesses will need to adapt if they are to survive and prospect under the criteria of the 13th Five Year Plan.

The 13th Five Year Plan is a platform for the next five years of economic activity meaning that the impacts can be strategically profound and long-term for international interests. Movement towards a new economic form will continue to provide opportunities. There will be areas to profit within but also areas to progress with caution to minimize losses. We are all watching closely to find out the outcome of the Five Year Plan’s details at the Lianghui in March 2016 and the exact implications of China’s “new direction” from economic transition.

Kiran Patel is the Marketing and Communications Director at LehmanBrown International Accountants.